Our goal is to provide information to help you get started with filing your taxes.

As a business owner, do you know what you need for tax season? There are a large number of things to keep track of as tax season rolls around, which includes everything from profit and loss statements to balance sheets. If you've just recently started your business, it can be difficult to prepare for tax season when you have a wide range of important business tasks to tend to. In order to mitigate some of these difficulties, it's recommended that you create a tax preparation checklist, which should help you keep track of everything involved with filing your taxes.

Even though preparing for your tax return can be daunting, the following checklist should cover everything that's needed for taxes. Whether you are a small business that has been operational for years or are a new startup that's preparing your first tax return, this checklist is a comprehensive one. Keep in mind that this is not direct legal or tax advice.

Our goal is to provide information to help you get started with filing your taxes. Please consult a professional before you make any final tax or financial decisions.

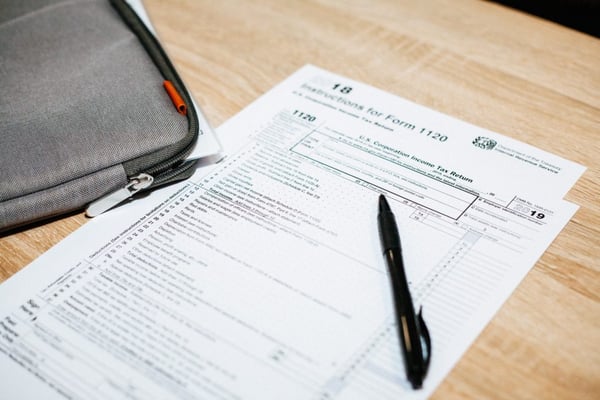

The first and likely most important aspect of any tax preparation checklist is to make sure that you file the correct tax form according to your business structure. Different tax forms are used for different business structures. If you file the incorrect tax form, you would likely be required to send in revised tax forms, which only serves to waste more of your time.

These are all of the basic tax forms that you will need to file depending on the type of business structure your company has.

It's also very important that you understand what your tax filing deadline is to make sure that you aren't late with filing your return or making your payments. The penalty for filing your tax return late is five percent of the taxes that you owe for every month that you owe them, which can compound to 25 percent. If you forget to file your tax return until over 60 days following the due date, the minimum penalty that you will be assessed is either $210 or 100 percent of the taxes that you owe.

The filing deadline for partnerships, S corporations, and multi-member LLCs is March 15. On the other hand, the filing deadline for single-member LLCs and sole proprietorships is April 15. The April deadline also applies to corporations that officially conclude their business year on December 31 and multi-member LLCs that are currently taxed as corporations. Now that you know when you should pay your taxes, you should be able to avoid any late filing fees or late payment fees.

Providing this information is important because it creates detailed records for when your business paid their taxes, which can be important if ever your business is audited. You need to get this information right because any errors can create delays with the refund that you're owed. Even a simple delay like writing down a slightly incorrect social security number can create significant delays with your refund.

While providing the right personal information is essential if you want your tax return to be properly processed, you will also need a substantial amount of financial records on hand to make sure that you correctly fill out the necessary tax forms.

As touched upon previously, it's important that you keep all of the receipts related to your business expenses on hand in the event that they need to be addressed when you prepare your taxes. The reason why you should know where these receipts are is because they can be used as deductions on your taxes.

The IRS also requires that businesses keep this documentation. In fact, bank statements for your business can't be used to replace any expense receipts that you might have lost. It's recommended that you keep these receipts for at least six years following the date of the return. If ever the IRS decides to audit your company, these expense receipts will likely come in handy.

Tax deductions and credits are highly beneficial when filing your taxes because they allow you to lessen the amount of money that you owe or increase your tax refund. Keep in mind that deductions and credits function slightly differently. For instance, deductions lower the amount of business income that can be taxed. On the other hand, credits directly lower the amount of money that you owe.

Along with everything mentioned previously, it's also possible to deduct estimated tax payments. If you are currently self-employed, you are required to make estimated tax payments in order to cover your liabilities since there's no employer to withhold a percentage of your wages. Business owners must pay these estimated taxes on a quarterly basis. If you do so, it's possible to deduct these taxes from your total liability on your yearly return, which allows you to avoid overpaying.

Before you actually file your return, it's recommended that you talk directly to your accountant or bookkeeper. Once you've filled out your return from all of the aforementioned steps, your accountant or bookkeeper will be able to determine if your tax return is wholly accurate.

They could also identify some other credits or deductions that you might have missed. These individuals can answer any tax questions that you might have and will be able to guide you through the process of filing your return.

While the tax filing deadlines are either March 15 or April 15 depending on what type of business you own, it's possible to request a tax filing extension if absolutely necessary. If you're unable to file on time for whatever reason, you can request one of these extensions from the IRS.

When you e-file for an extension at this link, you will be given until the fall to file your tax return. This option can be used if you haven't had time to properly prepare your tax return. You will still be required to estimate your tax liability and pay the necessary taxes. Otherwise, penalties will accrue.

All that's left for you to do is to file your tax return, which can be done online or through the mail. Before you file your return, keep in mind that e-filing is quicker and will allow you to receive confirmation that your return was filed correctly. If you file via the IRS, it's possible to make your payments with their EFTPS system, which allows you to make quick online payments.

It's important to be prepared with a small business tax preparation checklist because you're undoubtedly busy with running your company and could easily miss something if you don't have a checklist to address along the way. With this checklist in hand, you can complete your taxes in a structured manner, which should significantly reduce the possibility that you make a mistake.

The tax preparation checklist that you create should include filing the right tax forms, filing your taxes by the deadline, requesting a filing extension if needed, gathering all of your personal and financial records, and using any deductions and credits that could apply to your business.

If you want some additional resources to learn more about taxes and how to file them, you can go directly to the IRS website, take some lessons about taxes at this link, or read through other online resources.

Make sure that you speak to your accountant or bookkeeper as well if you have any questions about your taxes. Once you've paid your taxes and are planning the next stages of growth for your business, consider applying to our wet-lab incubator at University Lab Partners. At this incubator, you will have the equipment and space that you need to conduct research for your company or start developing products.

Revised 11/16/2020

Download The Ultimate Guide to Wet Lab Incubators in Southern California, a handbook to assist life science start-ups through the entire decision-making process to find wet lab space.

Download Now